2023-2026 Business Plan

This document contains forward-looking statements about iGO's expected or potential future business and financial performance. Forward-looking statements include, but are not limited to, statements about possible operator launches, future revenue and profit guidance, and other statements about future events or conditions. Forward-looking statements are not guarantees of future performance and involve risks and uncertainties that could cause actual results to differ materially from those projected. These risks and uncertainties include, but are not limited to, the uncertain economic environment; fluctuations in customer demand; and changes in government or regulation. Although such statements are based on Management’s current estimates and expectations and currently available competitive, financial and economic data, forward-looking statements are inherently uncertain. The reader is cautioned that a variety of factors could cause business conditions and results to differ materially from what is contained herein. The information contained in this document is current to December 2022.

Table of Contents

Section 2: Mandate

Vision, Mission and Values

Section 3: Overview of Programs and Activities

Section 4: Environmental Scan and Risks

Section 5: Strategic Directions and Implementation Plan

Growing the Economy

Breaking Down Barriers

Empowering Customers

Building iGO Up

Section 6: Staffing, Human Resources and Compensation Strategy

Section 7: Information Technology (IT) / Electronic Service Delivery (ESD) Plan

Section 8: Initiatives Involving Third Parties

Section 10: Diversity, Inclusion and Environmental, Social and Governance (ESG) Planning

Section 11: Multi-Year Accessibility Plan

Section 12: Three-Year Financial Plan

Section 13: Performance Measures and Targets

List of Tables

Table 1: iGO's Quarterly Market Performance Reports (Q1 and Q2)

Table 2: iGO Headcount (Staff and Board)

Table 3: iGO's Current Organizational Structure

Section 1: Executive Summary

In developing this 2023-2026 Business Plan, iGaming Ontario (iGO) considered the age of the organization, market, and our vision to lead the world’s best gaming jurisdiction. Since our establishment in July 2021 and the market launch in April 2022, iGO has been focused on successfully launching the igaming market. Over the past several months, iGO has begun transitioning from designing and onboarding operators to establishing a strategic direction that will allow us to continue to deliver on our provincially legislated mandate.

As the organization moves forward, this business plan will help guide both its day-to-day and its longer-term strategic decisions. Keeping iGO’s values of fun, respect, empowerment and excellence top of mind will ensure that iGO delivers on its vision to lead the world’s best gaming market. As seen throughout the business plan, achieving that vision is no simple task. iGO has set out a series of key performance indicators that it will use to measure progress toward that goal as well as a series of internal pillars that ensure consistency and performance across all aspects of the organization. With this in mind, iGO will work to Grow the Economy, Break Down Barriers, Empower Customers and Build iGO Up, all while delivering on the mandate given to it by government to achieve the maximum possible return for the government and its taxpayers. Detailed plans on how iGO will accomplish these tasks are explained below.

Section 2: Mandate

iGO's core mandate is to conduct and manage prescribed igaming lottery schemes while promoting responsible gambling. iGO received its mandate via O. Reg 517/21 under the Alcohol, Cannabis and Gaming Regulation and Public Protection Act, 1996 and continued under O.Reg 722/21 under the Alcohol and Gaming Commission of Ontario Act, 2019.

iGO is governed by its own Board of Directors and executes its mandate to conduct and manage internet gaming in the province when provided through private gaming operators who act as agents on iGO’s behalf.

iGO is committed to supporting the Government of Ontario’s objectives to provide an expanded igaming market that provides consumer choice and enhanced entertainment choices for players; consumer protection to ensure safer and responsible play; support legal market growth and capture revenue; and enable innovation and speed to market by reducing red tape.

Vision, Mission and Values

To support the agency in successfully delivering its mandate, iGO has developed a vision, mission and value set to guide its operations.

The Vision

To Lead the World’s Best Gaming Market

The Mission

To conduct and manage Ontario’s safe, efficient, and legal world-class igaming market

The Values

Fun

We facilitate new and exciting entertainment choices for players.

Respect

We promote responsible gaming, value diversity, equity and inclusion, and treat one another with respect.

Empowerment

We enable innovation and speed to market by reducing red tape and leveraging private sector expertise.

Section 3: Overview of Programs and Activities

iGO conducts and manages internet gaming in the province when provided through private gaming operators who act as agents on iGO’s behalf. iGO has, and continues to, enter into operating agreements with operators who meet rigorous standards of game and operator integrity, fairness, player protection and social responsibility, allowing all players to play with confidence. A share of revenues generated by these commercial relationships will be returned to the Government of Ontario to support provincial priorities.

iGO was officially created on July 6, 2021. Between iGO’s founding and the beginning of the 2023-24 fiscal year, iGO was tasked with creating the conduct and manage framework for the launch of Ontario’s legal, regulated and safe igaming market, which launched on April 4, 2022, and ensuring the orderly operation of the market thereafter. To both launch and conduct and manage the market in a short time frame, iGO set a series of operational priorities including ensuring consumer choice and protection, growing the regulated market, building in-house infrastructure and controls to process operator payments and data, establishing anti-money laundering processes, reducing red tape, creating a people-centric organization, and establishing governance and operational capabilities. These priorities guided iGO throughout its first two years of existence.

Consumer Choice

iGO has created a framework that supports an attractive, open and competitive igaming market to ensure world-class products and user experiences for Ontario consumers. In that work iGO signed over 100 non-disclosure agreements with prospective operators large, small, foreign and domestic to ensure they were able to understand the requirements of the Ontario market before committing resources to launch. The organization also established the game catalogue and game conditions policies that determined what offerings would be legal to provide in the Ontario market, which include peer-to-peer poker, sports betting, casino games and novelty betting.

Consumer Protection

iGO has several consumer protection policies in place and is actively working on future responsible gambling measures that include industry-leading requirements to ensure responsible gaming-focused advertising from operators, accreditation from the Responsible Gambling Council, and participation in a centralized self-exclusion program.

Customer care and dispute resolution policies have been developed that set out requirements and processes for players who have concerns or complaints related to products, services, or actions of an operator, all to ensure consumers are protected. iGO created an anti-money laundering and anti-terrorist financing program framework that includes policies, operational guidance, job aids and user guides for operators to ensure compliance with federal legislation.

Regulated Market Growth

iGO continues to work with the government and prospective operators to create market conditions that support economic development, weaken the illegal market and capture new provincial revenues. This includes participating in government-led consultations, engaging prospective operators via group and one-on-one conversations, and creating an iGO portal for operators where policies, FAQs and other guidance materials are available. iGO has conducted a series of educational webinars on the various components of the proposed Ontario market and created an account manager model assisted by a small team of finance, anti-money laundering, legal, information technology (IT) and market insights experts to ensure that all prospective operators receive assistance to navigate the onboarding process.

Reduced Red Tape

A key consideration when creating the rules and policies for the launch of Ontario’s regulated igaming market was to ensure the conduct and manage framework was as efficient and commercially attractive as possible while ensuring compliance with applicable legislation and world-class consumer protections and standards.

iGO continues to foster these close relationships with external parties to ensure its requirements and rules are not unnecessarily burdensome to operators and players alike.

People Centric

Given iGO’s recent start, the organization has been recruiting and training staff since day one. iGO has focused on doing this in an efficient manner while ensuring the organization built the foundation of an inclusive, forward-thinking and engaged workforce.

Governance & Operationalization

iGO has developed a financial and accounting framework to ensure appropriate financial reporting. The igaming model also required iGO to ensure compliance with the complexities of the GST/HST elements of the Excise Tax Act and implement banking relationships with major financial institutions. iGO also had to design and implement a financial system, a sound system of internal controls, back-of-house processes to enable the execution of operating agreements with operators, forecasting and analytics tools, and ensure these systems worked together to ensure seamless operation once the market launched.

Section 4: Environmental Scan and Risks

The risks affecting iGO’s performance and ability to deliver on its key performance indicators are best categorized into external and internal risks.

External Risks

iGO has entered into operating agreements with private gaming operators who operate internet gaming sites on behalf of iGO in accordance with these operating agreements. Given the collaboration with third-party operators, there are several potential risks to these operators that stand outside of iGO’s control.

By the end of the first week of April 2022, iGO saw 13 operators across 21 different websites go live in Ontario. By the end of November 2022, that number has grown to more than 35 operators and more than 65 different websites. When these operators choose to go live directly impacts the offerings to players and, in turn, the Gross Gaming Revenue (GGR) iGO collects. These operators have been affected by a host of external factors including the COVID-19 pandemic, talent shortages, the Ukraine-Russia War and cash flow issues.

Other external risks include economic factors, notably the impact of market conditions, including inflation, on both Ontarians’ levels of disposable income and the financial health of operators. Given gambling dollars are a form of entertainment spending, tougher economic conditions may reduce spending from Ontarians on discretionary activities, such as online gaming. Economic instability can impact iGO’s attainment of revenue targets and total wagers processed, either through operator health or through player wagers.

Given that most operators are digital businesses, they are also competing for talent with thousands of different industries around the world. Sourcing, recruiting, and retaining this talent will continue to be a challenge for operators and delays in hiring or repeated re-training can lead to delays in new product launches.

Cyber security is another external risk facing these companies. Given operators are digital companies with potentially large volumes of transactional information and money passing through their sites, they can be targets for hackers. These risks not only create financial risk for operators, and thus iGO as their conduct and manage entity, but also privacy concerns related to the release of personal information.

Lastly, the online gaming market is evolving rapidly. The legalization of the sector in North America is recent. As a result, many different operators are joining the market, all with different product offerings and business models. Inevitably, some of these business models will not succeed. Contrarily, some of these businesses will prioritize other jurisdictions or merge with/be acquired by other companies in this space.

Internal Risks

Like operators, iGO is also a tech-forward company that has unique skills needs across the organization. Finding, recruiting and retaining talent continues to be a focus for iGO’s senior leadership. Delay in hiring or higher levels of turnover, which the organization may begin to experience in a highly competitive environment, pose real risks to iGO’s attainment of goals and objectives.

Given iGO’s growth has happened over a short timeline largely occurring during the midst of the COVID-19 pandemic, iGO has become a hybrid workplace. This carries its own risks related to performance, evaluation, culture development and creativity. iGO is creating in-person options, mandatory office-wide town halls, and other team-building exercises to build comradery and foster creativity.

iGO continues to build on the strong foundation created by procuring various IT and technology systems to automate processes and create efficiencies. Given some of these products are unique to iGO’s needs, there are risks with design and implementation.

Section 5: Strategic Directions and Implementation Plan

As previously mentioned, iGO’s vision will be achieved through four pillars of activity: Breaking Down Barriers, Growing the Economy, Empowering Our Customers and Building iGO Up. The strategic directions for iGO are best categorized within each of these pillars.

Growing the Economy

Launching the Market

iGO achieved its primary goal for the 2022-2023 year with the successful launch of Ontario’s regulated igaming market on April 4, 2022. The opening of the market meant operators could offer their products, players could benefit from competition and choice in Ontario’s gaming market for the first time ever, and iGO could begin to generate revenue to offset its expenses and begin to earn a return to government.

In the first eight months since launch, iGO has onboarded more than 35 operators who, combined, provide over 65 different igaming sites to Ontario players. As of September 30, 2022, these operators have in aggregate processed over $10 billion in handle from some 628,000 active player accounts, generating approximately $429 million in GGR of which iGO retains a percentage. Operator sites vary in focus, featuring icasino games, sports betting options and peer-to-peer poker. They also contain a mix of foreign- and domestically owned sites, large- mid- and small-sized operators, and existing Ontario land-based operators. Each operator brings different products, strategies, and diversity to Ontario’s market, meaning competition, choice and options for players.

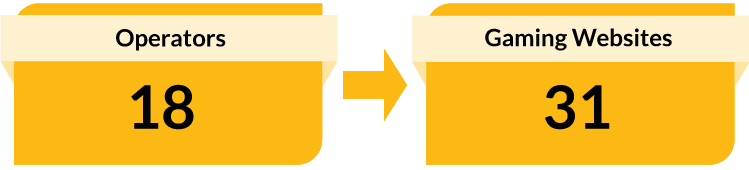

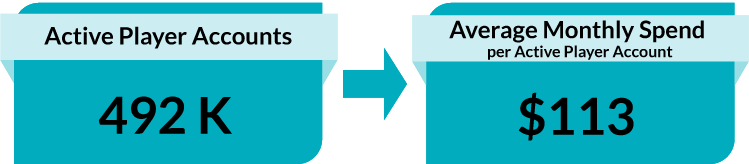

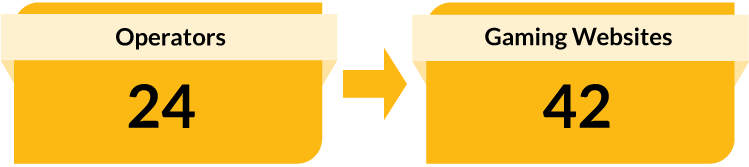

Table 1: iGO's Quarterly Market Performance Reports (Q1 and Q2)

iGO Fiscal Q1 — April 4 (market launch) to June 30, 2022

iGO Fiscal Q2 — July 1 to September 30, 2022

Notes for Table 1: iGO’s Quarterly Market Performance Reports

- The numbers in Table 1 are unaudited and subject to adjustment.

- Total Wagers does not include promotional wagers (bonuses).

- Total Gaming Revenue is total cash wagers, including rake fees, tournament fees and other fees, across all Operators minus player winnings derived from cash wagers and does not take into account operating costs or other liabilities.

- Number of Operators and gaming websites are as of the closing of each quarter.

- Active player accounts are accounts with cash and/or promotional wagering activity and do not represent unique players as individuals may have accounts with multiple Operators.

- The Ontario igaming market described in these reports includes all igaming Operators that operated pursuant to an operating agreement with iGO. As such, it does not include OLG’s igaming offering.

iGO has not only executed operating agreements with these 35+ operators, but also continued to work with dozens of prospective operators who have expressed an interest in joining the Ontario market. This interest is in part due to the large Ontario population and the mature market behaviour operators have already seen in the province. However, it can also be attributed to the province’s competitive revenue share rate, the legalization of icasino products instead of just sports betting, the recent legalization of single event sports wagering, the lack of land-based ties that are seen in other jurisdictions, and an open competitive process that does not feature an arbitrary cap on the amount of operators in the market.

When these market design factors are combined with an onboarding process that involves personalized account management support, operators are not just invited to join the Ontario market but are welcomed with supportive processes. During onboarding iGO performs end-to-end testing and ensures operators follow anti-money laundering and other regulatory requirements. This onboarding work, completed and ongoing, is vital to iGO’s goals of channelizing both players and operators into the legal market.

Telling Ontario’s Story

Though there is significant interest in joining the market already, iGO is pursuing channelization goals that encourage as many operators as possible to join. This means iGO not only needs to process the queue of prospective operators already interested, but also tell Ontario’s positive story to the world. iGO has executed the beginning of an economic development strategy which includes a commitment to releasing quarterly market updates about the size and strength of Ontario’s igaming market and regular appearances at conferences and panels where operators and suppliers would be in attendance. Some of these venues include the Canadian Gaming Summit, G2E Global Gaming Conference, the SiGMA Americas World iGaming Festival, the Commercial Gaming Association of Ontario/Ontario Charitable Gaming Association Joint Conference and the ICE Gaming Conference. iGO's first quarter market performance report generated over 71 million social media impressions and the second quarter market report was unveiled live at the G2E Global Gaming Conference in Las Vegas, Nevada to a wide audience of current and prospective operators.

iGO is working toward market insights reporting that takes advantage of iGO’s unique position as a central data hub to provide valuable information to the industry regarding player behaviour and trends. These initiatives will help operators refine products to meet consumer needs, creating a better playing experience and help to maximize capture of potential revenue that could otherwise be diverted to the illegal market. These insights include ongoing work to capture the full economic benefit of the industry, direct and indirect, to the province of Ontario. The work to collect and process this data has already begun, with the reports to be generated in future fiscal years.

Helping Promote the Legal Market

Though iGO is not the regulator and does not carry legal enforcement powers, it can help the Ontario Government pursue the overall goal of eliminating the illegal igaming market. First, iGO has and will continue to work with operators who follow the standards set by the Alcohol and Gaming Commission of Ontario (AGCO) and the conditions set out by iGO. This includes those companies that shut down illegal market operations in accordance with the AGCO’s October 31, 2022 deadline and instead worked with iGO to join the legal market. The process of helping operators to convert their organization and their players into the legal market is the first and most effective step in combatting the illegal market.

Second, iGO has a role to play in educating third-party actors, including players, of the difference between the new legal market and the illegal market. Awareness efforts such as promotional campaigns, requirements for display of the iGO logo on all advertising and operational sites, and helping educate companies such as advertising agencies or payment processors of the benefit of working solely with legal operators, all work in concert to reduce the appeal of illegal market operators. iGO is committed to working with its government partners, including the AGCO, to further weaken the illegal market and make it more difficult for them to operate within Ontario’s borders.

Breaking Down Barriers

Improving the Market

iGO continues to work closely with the operators in Ontario’s igaming market to ensure compliance with the operating agreement and other regulatory and legislative obligations. This includes tasks such as receiving performance security deposits, enforcing insurance requirements, collecting gaming data from operators, collecting GGR from operators, and complying with anti-money laundering reporting requirements to the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC).

To ensure iGO is as efficient and productive as possible, iGO account managers continue to have regular post go-live meetings to troubleshoot issues. iGO participates in regular communication with operators through its external consultation platform iGOConnect.ca, ad-hoc conversations and meetings with operators, and through its newly launched iGO Operator Roundtable, which meets at minimum semi-annually. These roundtables enable the discussion of emerging issues in the gaming space and the collection of feedback on proposed initiatives and policy changes. These channels of communication assist iGO in refining its policies, the operating agreement, and contemplate future unforeseen issues.

Pursuing Workable Solutions

To continue to improve and grow the market, iGO is committed to working with government partners to solve remaining regulatory and legislative barriers that may exist. This includes, supporting omni-channel player accounts for Ontario’s existing land-based operators that may seek to open igaming sites - including charitable gaming venues and bingo halls.

These new ventures will help ensure Ontario’s gaming market is a world leader and iGO is committed to working with its partners to develop these opportunities. Depending on the timing, cadence and details surrounding these solutions, iGO may need to hire additional resources and change the organizational structure to incorporate these new lines of business or operations.

Gathering Direct Feedback

In addition to the Operator Roundtable process, iGO also intends to monitor and track player feedback through call centre complaints made to the joint iGO/AGCO customer service centre. iGO also plans to launch a process to gather direct feedback from players, though the mechanisms for that outreach are still being decided. Lastly, given iGO’s unique position as a central repository of igaming-related data iGO can derive and share valuable Ontario market insights and observations. iGO intends to publish these findings to better inform operators and players, thereby allowing the creation of better products and continued investment in the province.

Empowering Customers

Improving the Operator Onboarding Process

iGO has reviewed its onboarding process to reduce unnecessary inputs, eliminate friction in the process, and reduce the overall time to go live for prospective operators. This work becomes increasingly important as interest in joining has accelerated with the passing of the AGCO’s October 31, 2022 deadline requiring the shuttering of operations in the illegal market. By focusing additional resources, even if on a temporary basis, iGO can ensure an efficient onboarding process to further grow the market and simultaneously reduce the size of the illegal market in Ontario.

Anti-Money Laundering Tools

As the conduct and manage entity for igaming in Ontario, iGO must report to FINTRAC when certain occurrences happen in the market such as large deposits or withdrawals. Given the size of the market, iGO has processed nearly 7,000 reports to FINTRAC in just the first six months of operations. Currently, these reports are processed manually, taking up significant time and resources. As a result, iGO plans to procure and implement a third-party reporting solution that will automate the required anti-money laundering process and reduce the need for manual staff input all while improving efficiency.

Responsible Gambling Tools

Core to iGO’s mandate is the promotion of responsible gambling measures as a key function of the market. Allowing players to self-exclude from sites is mandatory, thereby allowing players a mechanism to take a break from play and end all direct marketing towards them via email, notification, or other method. iGO operators must also obtain RG Check accreditation from the Responsible Gambling Council within two years of go-live, meaning much of this work is already underway.

iGO is actively working on requirements for operators to dedicate a portion of their GGR to responsible gambling advertising and the creation of a centralized self-exclusion system that enables players to self-exclude from all iGO websites at once. iGO intends to implement these requirements during the 2023-2024 fiscal year. All told, these measures empower customers to protect themselves from the risks of gambling and play with confidence.

Building iGO UP

Ensuring the Right Staff Complement

iGO staff play a critical role in delivering on the agency’s mandate. As the organization moves forward, it will transition to regular operations instead of launching the new market and onboarding operators.

Going Digital First

iGO’s operator companies provide an online service to Ontario players. As a result, almost all their interactions with players – and by extension iGO’s interaction with players – are online. iGO needs to be a digital first organization to lead the world’s best gaming market. Processing the millions of pieces of gaming data, millions of dollars of GGR payments, and thousands of anti-money laundering reports per year requires significant digital infrastructure.

iGO is currently undergoing a series of procurements for infrastructure technology systems that will allow iGO resources to be centrally located on its own tenant, the safe and secure storage of information including any privacy related information about players, automate anti-money laundering reporting and processing, and allow automated reporting and sorting of gaming related data for market insight and reporting purposes. Each of these systems may require larger one-time financial resources and, depending on the system, permanent staffing resources to oversee their operations and utilize the data collected. This work will be performed throughout the 2023-2024 year.

Building Internal Processes

As iGO is a new organization, many internal processes and policies had to be created for the first time. The Board of Directors, and its two sub-committees, were previously seized with approving these policies and assisting in building the foundation of the organization. Now, given many of the needed policies were created in the 2022-2023 fiscal year, the Board can transition to one that provides longer-term strategic direction and performs regular evaluations of the organization against its stated objectives.

Section 6: Staffing, Human Resources and Compensation Strategy

During its first year, iGO has focused on establishing the foundational capabilities to support the growth and rapid evolution of the industry. Staff have worked tirelessly to ensure iGO meets its legislated mandate. iGO is committed to supporting its staff and to promote a culture of diversity, equity and inclusion, ensure strong succession planning and support a healthy life-work balance.

Hybrid Work

By embracing a hybrid work model, iGO can grow to the level needed to support its operations and strategic goals while still realizing the benefits of in-office work and collaboration when needed. Additionally, this flexibility enables iGO to recruit talent located across the province, not just in the Greater Toronto Area, thereby increasing iGO’s talent pool.

iGO’s Compensation Strategy

iGO’s compensation strategy, including employee benefits, is in line with the Broader Public Sector expectations and directives. iGO provides a comprehensive benefits package including the following:

- 100% Employer-Paid premiums for Basic Life, Basic AD&D, Health, Dental and Long-term Disability

- Defined Benefits Pension Plan administered by the Ontario Pension Board (for non-union employees) and OP Trust (for unionized staff)

- Short Term Income Protection for permanent staff to a maximum of six months (130 working days) in the calendar year

Bargaining Agent

The bargaining unit for iGO is OPSEU Local 565 and represents 70% of the iGO workforce.

iGO Headcount

iGO’s current staffing allocation totals 72 staff members (breakdown below), not including the Board of Directors, though some of these positions are still being hired for.

iGO has utilized outside expertise and services where necessary and has also used both contract and temporary staff to ensure the right size and fit for iGO.

Table 2: iGO Headcount (Staff and Board)

Management

Non-Management

Total

Permanent Full-Time

21

42

63

Contract

1

5

6

Temporary

0

3

3

Total Staff

72

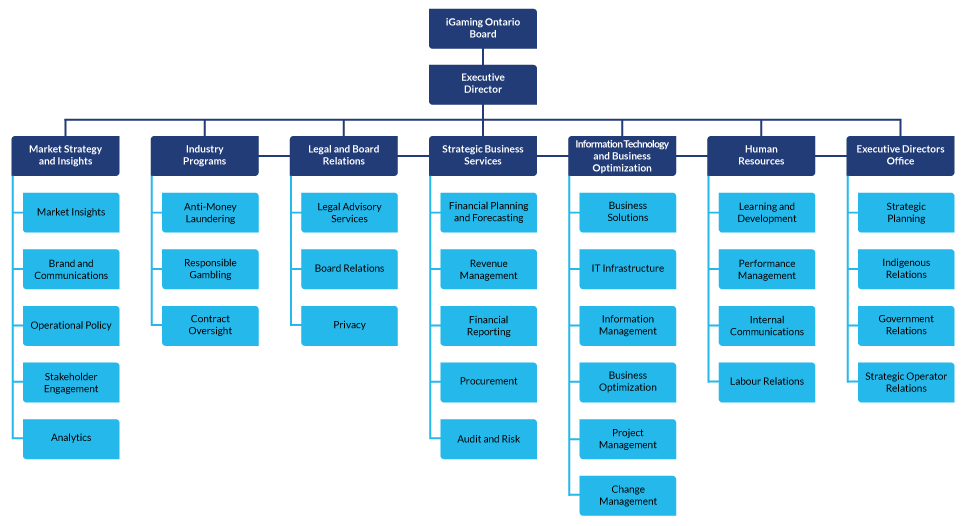

iGO’s current organizational structure is captured below. The organization is separated into 7 business units, each run by management level staff.

Table 3: iGO's Current Organizational Structure

iGO's Current Organizational Structure (Accessible view)

- iGaming Ontario Board

- Executive Director

- Market Strategy and Insights

- Market Insights

- Brand and Communications

- Operational Policy

- Stakeholder Engagement

- Analytics

- Industry Programs

- Anti-Money Laundering

- Responsible Gambling

- Contract Oversight

- Legal and Board Relations

- Legal Advisory Services

- Board Relations

- Privacy

- Strategic Business Services

- Financial Planning and Forecasting

- Revenue Management

- Financial Reporting

- Procurement

- Audit and Risk

- Information Technology and Business Optimization

- Business Solutions

- IT Infrastructure

- Information Management

- Business Optimization

- Project Management

- Change Management

- Human Resources

- Learning and Development

- Performance Management

- Internal Communications

- Labour Relations

- Executive Directors Office

- StrategicPlanning

- Indigenous Relations

- Government Relations

- Strategic Operator Relations

- Market Strategy and Insights

- Executive Director

Section 7: Information Technology (IT) / Electronic Service Delivery (ESD) Plan

Investment in iGO’s IT infrastructure is critical to meeting our strategic goals. Significant progress was achieved in prior fiscal years to realize iGO’s immediate goals of achieving technological self-sufficiency, building a strong IT team and procuring the necessary Managed Detection and Response (MDR) cybersecurity services. The focus for the next three years now becomes automating and introducing efficiencies through technology.

An anti-money laundering system that integrates directly with operators to ingest suspicious transactions and identify high risk activities is critical. iGO will be pursuing this along with other integrations that will include batch transfer to FINTRAC. Considering the tight deadlines and risk of penalties due to non-compliance, iGO will need to leverage automation as well as advanced analytics to ensure that no detail goes untracked. This is a priority over the business plan period.

The responsible gambling team at iGO is implementing a province-wide self-exclusion registry that will be easy to access for operators, but also secure given the sensitive personal nature of the information. This is a shared priority for both operators and iGO moving forward.

iGO is also collecting market insight data that is well structured and stored in text-based files. In its current format, it is challenging to process spreadsheets with millions of records to present information in dashboards and more consumable formats for both internal tracking and external market awareness. Therefore, a key priority will be to develop data warehousing capabilities to scale and grow with the vast amount of data being collected. The data should be easily accessible for analysis and on-demand dashboard reporting.

Section 8: Initiatives Involving Third Parties

iGO’s core operations rely on external third-party agents that provide services to Ontarians on iGO’s behalf. Therefore, most every initiative iGO undertakes involves third parties in some capacity. This means that external engagements with third parties are pivotal to iGO’s ongoing success and igaming market growth.

iGO will pursue feedback opportunities with players, including the continued monitoring of its customer call centre.

iGO will continue to work with external partners who either work in conjunction with or alongside iGO. This includes the AGCO as the regulator of iGO, the Ontario Lottery and Gaming Corporation as a fellow conduct and manage entity in Ontario where joint efficiencies can be achieved, the Ontario Provincial Police and FINTRAC as it relates to anti-money laundering work, the Responsible Gambling Council as it relates to responsible gaming measures, the Government of Ontario and its Ministries, Indigenous representatives including the Ontario First Nations Limited Partnership (OFNLP), and third-party associations representing the industry and its economic development opportunities such as the Canadian Gaming Association or Ontario based post-secondary institutions.

Section 9: Communication Plan

To deliver on its mandate, iGO must clearly and consistently communicate to both internal and external stakeholders. An effective communications strategy is critical in ensuring players can play with confidence that they are playing on a site that is safe as well as better informing Ontarians about the new igaming market and its benefits.

Website

The iGO website launched in 2021-2022 and is consistently updated with relevant content, including a live list of regulated operators and quarterly market updates regarding iGO’s performance. The site is separated into two portals, one for players and another for operators.

The player portal contains information on which sites are regulated and live, responsible gambling tools and information about the benefits of the legal market. There is also an escalation path for dispute resolution should any players have concerns about their dealings with an operator. On the operator side there is information explaining how to join Ontario’s legal market, the benefits of doing so, and links to iGOConnect.ca, which is iGO’s operator engagement tool.

Social Media

iGO is using social media (Twitter, LinkedIn and Instagram) to engage proactively with Ontarians about operators that have joined the legal market, responsible gambling tools, and other important messages such as iGO’s quarterly performance. In addition to proactively informing the public of igaming related developments via these channels, iGO also uses these tools for proactive monitoring of iGO mentions and broader igaming topics in Ontario. This ensures the voice of the player is captured in iGO decision making and immediate response to consumer related issues with operators or the igaming market more generally.

Media Relations

iGO regularly communicates with members of the media to provide information needed for their articles and coverage and to tell iGO’s story, including the benefits of the legal market, to the public in the most efficient way possible. This includes proactive press releases and responding to media inquiries on an as needed basis.

Section 10: Diversity, Inclusion and Environmental, Social and Governance (ESG) Planning

Diversity and Inclusion

iGO is committed to being a diverse and inclusive workplace for all. iGO, in all its decision making, prioritizes the needs of its current and future potential workforce, including women, racialized communities, Indigenous peoples, LBGBTQ2S+ community and persons with disabilities. As iGO grows and creates internal policies, this lens will be applied, ensuring that diversity and inclusion planning is a core tenet from the outset, not a future edit or afterthought.

ESG Approach

iGO has prioritized an ESG approach in its work from its inception. Given iGO’s operators provide a digital service, embedding a digital first philosophy that reduces environmental waste is a core tenet of iGO’s business. On social matters, iGO has created an internal Corporate Social Responsibility committee to spearhead social initiatives such as United Way fundraising campaigns and the creation of volunteer days for staff to dedicate themselves to important community causes. On governance, iGO’s board has created Conflict of Interest policies, committed to the transparent and open publication of data on a regular basis, and embedded practices that meet the highest levels of integrity and accountability to the Government and the people of Ontario.

Section 11: Multi-Year Accessibility Plan

iGO’s accessibility plan and policies are currently under development. Though this process is underway, these policies will be created in accordance with the Integrated Accessibility Standards Regulation (IASR) under the Accessibility for Ontarians with Disabilities Act, 2005. iGO will strive to remove barriers for people with disabilities and to create a workplace that is accessible for all. iGO is committed to a future where all external documents created by the organization, including this one, are presented in an accessible format, thereby meeting the Web Content Accessibility Guidelines.

As part of iGO’s shared services agreement with the AGCO, every iGO employee since day one has been trained on the requirements of Ontario’s accessibility laws, including the IASR and the Ontario Human Rights Code as it pertains to persons with disabilities. This accessibility training has been built into the employee orientation process to ensure that iGO employees and the Board of Directors, have a thorough and understanding of accessibility challenges and responses.

Section 12: Three-Year Financial Plan

Table 4: iGO's Three-Year Financial Plan

(In Millions $)

FY22-23 Forecast

FY23-24 Budget

FY24-25 Plan

FY25-26 Plan

REVENUE

Adjusted GGR (AGGR)

1,078.4

1,121.3

1,165.0

1,310.6

Less: Operator Revenue Share

862.7

897.0

932.0

1,048.5

iGO Share of AGGR

215.7

224.3

233.0

262.1

Other Income

4.3

2.6

1.4

1.4

Total iGO Revenue

220.0

226.9

234.4

263.5

EXPENSES

Total Salaries & Benefits

9.3

12.4

13.8

14.4

Total Other Direct Operating Expenses

9.2

12.5

13.2

12.5

Total Expenses before Stakeholder Payments

18.5

24.9

27.0

26.9

SURPLUS BEFORE STAKEHOLDER PAYMENTS

201.5

202.0

207.4

236.6

HST Expense

114.4

119.7

124.8

139.7

Gaming Revenue Share Financial Agreement Expense

-

20.4

21.2

22.0

SURPLUS AFTER STAKEHOLDER PAYMENTS

87.1

61.9

61.4

74.9

Provincial Portion of HST Refunded1

42.3

44.3

46.1

51.7

TOTAL iGO CONTRIBUTION TO PROVINCE

129.4

106.2

107.5

126.6

[1] Assumes ~37% of GST/HST paid to Canada Revenue Agency (CRA) is recovered by the Province of Ontario.

Building from the exceptionally strong igaming market launch in the 2022-2023 fiscal year, iGO looks to carry forward the positive momentum surrounding market launch into the next three fiscal years. Throughout the next three years, iGO is planning to carry out various initiatives aligned to each of its core pillars (Breaking Down Barriers, Growing the Economy, Empowering Customers and Building iGO Up). These activities will enable the achievement of its key performance indicators and deliver greater reliability and performance.

iGO is expecting the igaming market to continue its growth trajectory into fiscal 2023-2024 with gross gaming revenue growing year-over-year and iGO’s share of the Adjusted Gross Gaming Revenue (AGGR) increasing in step. That said, the financial projections above include the potential impact of mild recessionary economic events expected over the next two fiscal years. As a result, the next two years see AGGR growing at a modest 4% rate, followed by a more accelerated growth of 12% in fiscal year 2025-2026, where economic conditions are assumed to improve.

Fiscal 2023-2024 sees an increase in expenses, in part driven by the fact that 2022-2023 was a build year, with staff being hired throughout the year. As a result, the full-year impact of some of these costs, such as salaries and benefits, are realized in 2023-2024. Additionally, year one was focused on helping operators successfully onboard into the regulated igaming market. Expenses in fiscal 2023-2024 and beyond reflect increases aligned to the delivery of key business objectives.

iGO's Stakeholder Payments are also higher in 2023-2024 and increase thereafter. These payments reflect the legislated GST/HST payments in accordance with the Excise Tax Act (where expenses increase in step with increased Operator Revenue Share payments) and the introduction of the new revenue share agreement with OFNLP. It should be noted that approximately 37% of all GST/HST payments to the Canada Revenue Agency are recovered by the province of Ontario, thereby increasing the total contribution from iGO to the province.

iGO’s 2023-2024 Surplus before Stakeholder Payments, at $202 million, remains flat to 2022-2023, before increasing year-over-year in both 2024-2025 and 2025-2026, resulting in a 17% increase over the three-year planning period. This significant growth is aligned with its key performance indicator under the Growing the Economy pillar, which projects 5% average annual growth in this metric over the planning period.

Over this same three-year period, the total year-end contribution to the province is projected to grow at an impressive 19% rate, from $106.2 million in 2023-2024 to $126.6 million in 2025-2026. This reflects an average annual growth rate of approximately 6.4%, indicative of the strong market response to the new igaming market.

Section 13: Performance Measures and Targets

For the 2023-2024 fiscal year and beyond, iGO has identified six key performance indicators (KPIs) to measure the performance of the organization. Given the newness of the organization, some of these key performance indicators still require baselines to be set and benchmarking to be conducted to evaluate progress and conduct future measurement exercises.

These KPIs were chosen to ensure an organization-wide view of effectiveness across the seven business units. In addition, they reflect the priorities of iGO management, the iGO Board of Directors and the Government of Ontario seen in the organization’s mandate. Lastly, in addition to these key performance indicators, iGO has established goals within each of these pillars that contribute to the overall progress in achieving each of these KPIs. These more detailed goals will be tracked internally for the iGO Board of Directors to review to ensure success and achievement of the organization’s KPIs.

Table 5: iGO's Performance Measures and Targets

Breaking Down Barriers

- Achieve 5% annual growth in channelization rate of players to the legal market, reaching 90% within 5 years

Growing the Economy

- Achieve 5% annual average growth in surplus before stakeholder payments between 2023-2024 and 2025-2026

Empowering Customers

- Establish baseline of operator evaluation to be used for future KPIs and evaluations

- Commit to setting targets for iGO player awareness of responsible gambling tools with a goal of increasing the awareness of these tools by 5% year-over-year

Building iGO Up

- Reduce iGO Touch Time on data and onboarding processes by 20%

- Establish baseline of employee engagement (% of employees that would recommend iGO as a place to work)

iGO has set a goal of achieving a 90% channelization rate of players to the legal market within five years, thereby weakening the impact and leverage of illegal market operators. This channelization rate would increase by 5% every year from the 2022-2023 goal of 70% channelization, ultimately building to an Ontario market where nearly every player is playing on a safe, regulated site that features world-class responsible gambling tools and revenues that return to the Province of Ontario. Given the unpredictability of the first year of the market, using a continual growth target ensures iGO continues to progress.

iGO is committed to growing its annual surplus by an average of 5% over the course of the business planning period. This target is reflected in Section 12: Three-Year Financial Plan and will ensure that iGO operates as efficiently as possible, providing the greatest financial benefit to the Government of Ontario and its taxpayers.

When it comes to customer interactions, be that players or operators, iGO plans to establish baselines for both operator feedback and player awareness of responsible gambling measures. By establishing baselines in both areas, iGO will set targets for performance and on a regular basis measure against those targets. iGO is actively working on establishing these baselines and expects them to be created, completed and tracked for the 2023-2024 fiscal year and beyond, and will be reflected in the KPIs established at that time.

Lastly, iGO has identified a pair of key performance targets related to iGO’s internal workings. Specifically, iGO is committed to reducing employee touch time on data and onboarding processes by 20% to increase efficiency and get operators to market faster, both of which advance channelization and dividend targets. iGO is establishing an employee engagement baseline that will enable measurement of employee satisfaction and tracking of that metric over time, ensuring iGO is creating a positive internal culture and environment.

Together, these six KPIs will ensure that iGO has concrete goals to guide it in the achievement of the mandate given to it by the Government of Ontario.