April 20, 2023

This iGaming Ontario (iGO) market performance report covers the fourth quarter (Q4) of the 2022-23 fiscal year (January 1 through March 31, 2023) as well as the full first year of market operations (April 4, 2022 through March 31, 2023).1

Q4 – Jan. 1, 2023 to

Mar. 31, 2023

Year One – Apr. 4, 2022 to

Mar. 31, 2023

To expand on the data above:

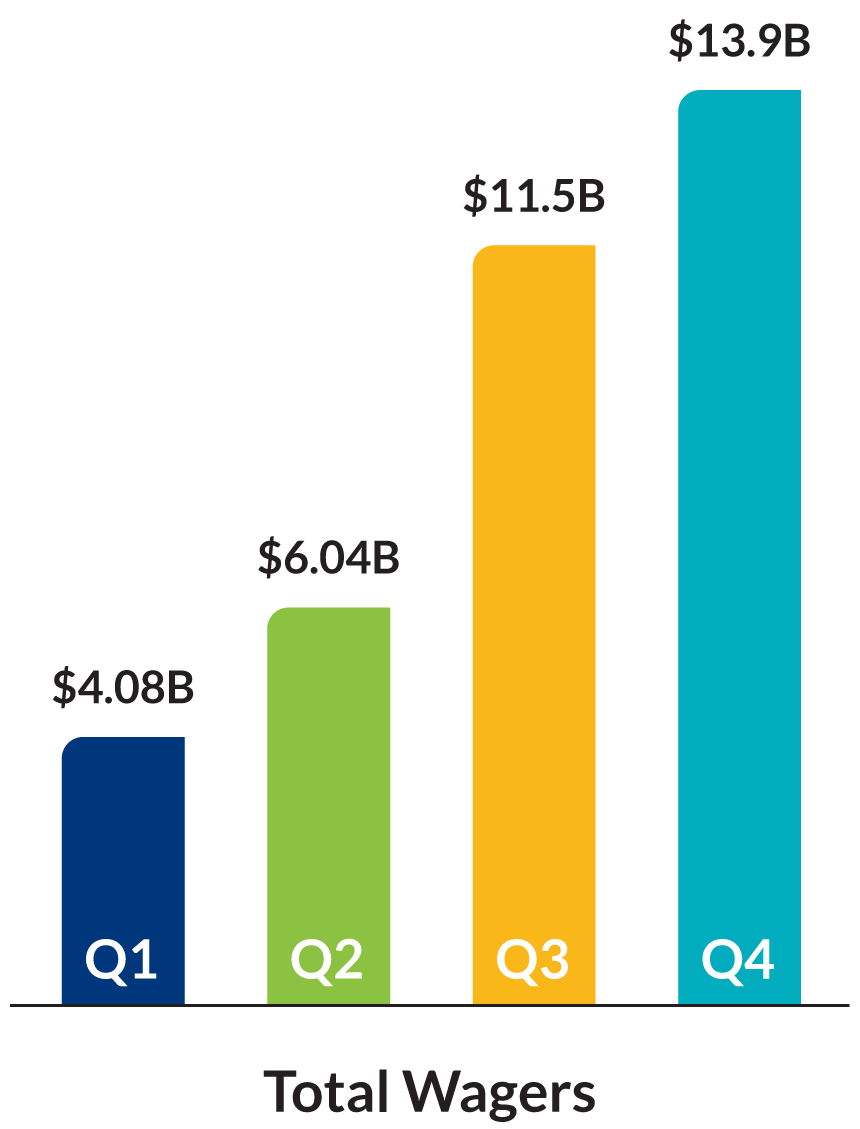

- Total wagers in Q4 of $13.9 billion bring the total wagers for the year to $35.5 billion. Total wagers do not include promotional wagers (bonuses).

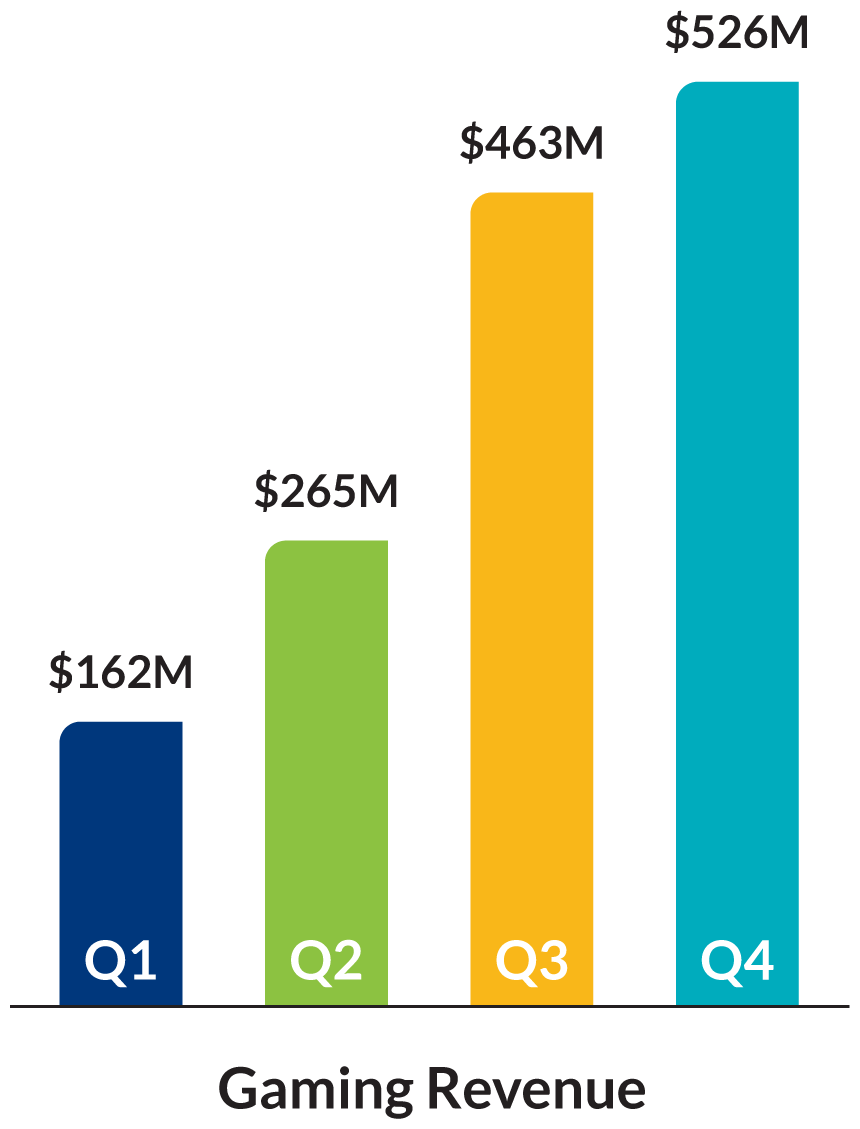

- Total gaming revenue in Q4 of $526 million brings the total gaming revenue for the full year to $1.4 billion. Total gaming revenue reported represents total cash wagers, including rake fees, tournament fees and other fees, across all Operators minus player winnings derived from cash wagers and does not take into account operating costs or other liabilities.

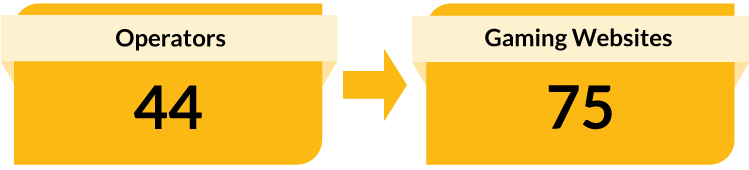

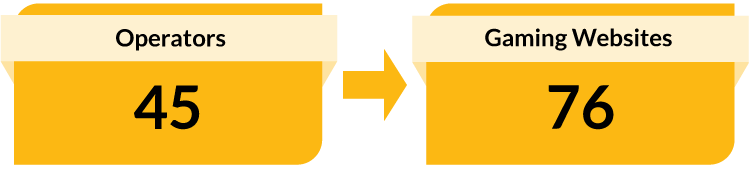

- A total of 44 Operators with 75 gaming websites contributed to wagers and revenues in Q4. This brings the total number of Operators and gaming websites that contributed to wagers and revenues for the year to 45 and 76, respectively. See the up-to-date list of Operators and gaming sites that are currently live.

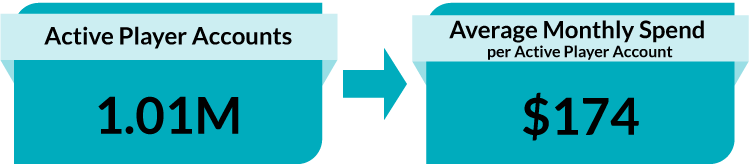

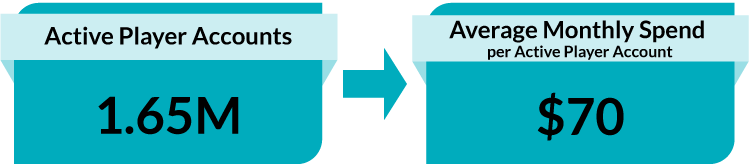

- Just over 1 million player accounts were active in Q4. There were 1.65 million player accounts that were active over the course of the year. Active player accounts are accounts with cash and/or promotional wagering activity during the time period and do not represent unique players as individuals may have accounts with multiple Operators.

- Average monthly spend per active player account was $174 in Q4. For player accounts that were active anytime over the year, the average monthly spend was $70 per active player account.

Gaming Revenue and Total Wagers by Quarter (April 4, 2022 – March 31, 2023)

- Since its launch on April 4, 2022, the new legal igaming market in Ontario has, on average, grown by more than 50% in total wagers and gaming revenue each quarter.

- Differences between the Q2 and Q3 gaming revenue numbers above and those reported in past iGO Market Performance Reports are the result of restatements.

Top 5 Sports by Total Wagers (April 4, 2022 – March 31, 2023)

- The most popular sport to bet on was basketball at 29% of betting wagers, followed by soccer at 15%, football at 13%, then hockey at 9% and baseball at 8%. Sports categories encompass wagers placed on a range of sporting events including but not limited to professional leagues.

Casino Segment Breakdown by Total Wagers (April 4, 2022 – March 31, 2023)

- Within the online casino category, nearly half (48%) of all casino wagers were on slots, nearly a third (32%) on table games with a live dealer, and the remainder (19%) on computer-based table games.

As part of its commitment to sharing aggregate revenue and market insight reports, iGO intends to continue releasing, at minimum, a market report on a quarterly basis.

General inquiries: igaming@igamingontario.ca | Media inquiries: igomedia@igamingontario.ca

1The numbers in this report are unaudited and subject to adjustment. The Ontario igaming market described in this report includes all igaming Operators that operated pursuant to an operating agreement with iGO from January 1 to March 31, 2023 in the case of Q4 reporting and from April 4, 2022 to March 31, 2023 in the case of year one reporting. As such, they do not include OLG’s igaming offering.